Tax System

💼 Taxation of Investments: How It Works and What You Need to Know

Those who start investing with our system also start generating profits. And as with any profitable activity, it’s important to understand from the beginning how to properly manage taxation.

With Mathematical Investor, you have two operational options:

Operate as an individual, directly from your personal account.

Establish a company, in Italy or abroad, and optimize taxation in a more advanced way.

In both cases, profits are taxed according to the laws of your country of tax residence. However, it is possible to adopt more advantageous solutions in a legal and transparent way, thanks to our international experience and the partners we have been working with for years.

💼 Taxation of Investments: How It Works and What You Need to Know

Those who start investing with our system also start generating profits. And as with any profitable activity, it’s important to understand from the beginning how to properly manage taxation.

With Mathematical Investor, you have two operational options:

Operate as an individual, directly from your personal account.

Establish a company, in Italy or abroad, and optimize taxation in a more advanced way.

In both cases, profits are taxed according to the laws of your country of tax residence. However, it is possible to adopt more advantageous solutions in a legal and transparent way, thanks to our international experience and the partners we have been working with for years.

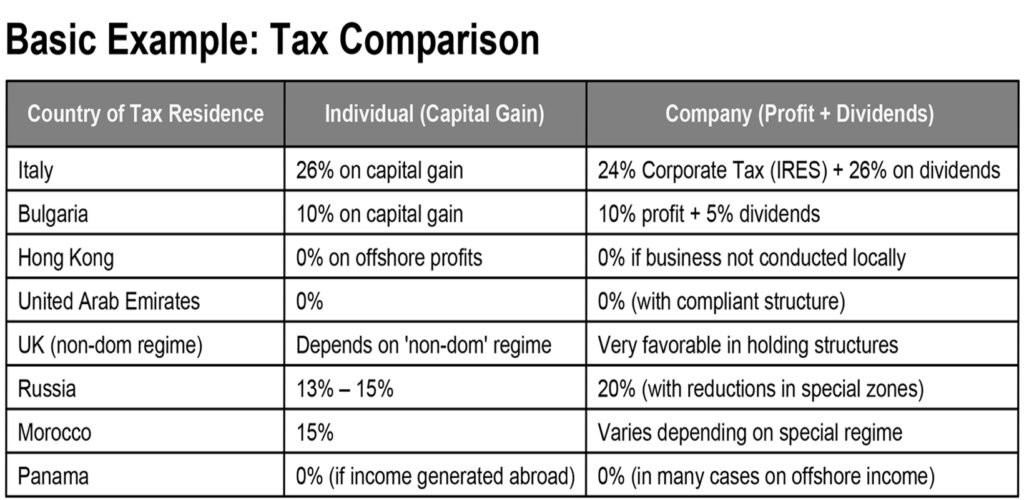

🌍 Capital Gains Taxation: an Overview

Capital Gain is the positive difference between what you invest and what you cash out, and it is taxed based on:

- the nature of the entity (individual or company)

- the tax jurisdiction (country of residence or incorporation)

- the local tax regime

🌍 Capital Gains Taxation: An Overview

Capital Gain is the positive difference between what you invest and what you cash out, and it is taxed based on:

– the nature of the entity (individual or company)

– the tax jurisdiction (country of residence or incorporation)

– the local tax regime

🧾 Individual or Company?

If your invested capital is below €50,000, you can start as an individual and later consider a more optimized structure.

If your capital is above €50,000 / €100,000, we recommend evaluating the opening of a foreign company to access more efficient taxation, such as:

• Bulgaria: simple regime, 10% flat tax

• Hong Kong: highly advantageous offshore taxation

• UAE (Dubai): tax exemption and strong banking system

• Panama: excellent for asset protection and international trading

🏛️ How does taxation work for companies?

Once the company is created, you will need to pay taxes on business profits. But the advantage is that you can deduct costs, defer personal taxation, and optimize dividend distribution.

✅ Example:

With a Bulgarian company: you pay 10% tax on profits and 5% on dividends (effective total 14.5% with tax treaties).

📌 Customized Solutions and Support

We are not tax advisors, but we work with professionals specialized in international taxation and connect you directly with them.

Depending on your situation and goals, you can:

Open a personal or corporate account on compatible platforms

Establish a foreign company with full documentation

Receive assistance for foreign tax residency or “non-dom” status

Access consulting sessions to evaluate the tax plan best suited to you

✈️ And for those who want to take a step forward?

If you want to live abroad or optimize your tax residency, we can also support you with:

– Applying for residency in Bulgaria or Hong Kong

– Transferring your tax domicile to low-tax countries

– Legal structuring for optimizing family wealth

🔐 Maximum freedom, no restrictions

Your capital always remains in your personal or corporate account, under your full control.

We do not manage your funds, but we provide you with a replicable strategy that you can follow freely.

📌 Customized Solutions and Support

We are not tax advisors, but we work with professionals specialized in international taxation and connect you directly with them.

Depending on your situation and goals, you can:

Open a personal or corporate account on compatible platforms

Establish a foreign company with full documentation

Receive assistance for foreign tax residency or “non-dom” status

Access consulting sessions to evaluate the tax plan best suited to you

✈️ And for those who want to take a step forward?

If you want to live abroad or optimize your tax residency, we can also support you with:

Applying for residency in Bulgaria or Hong Kong

Transferring your tax domicile to low-tax countries

Legal structuring for optimizing family wealth

🔐 Maximum freedom, no restrictions

Your capital always remains in your personal or corporate account, under your full control.

We do not manage your funds, but we provide you with a replicable strategy that you can follow freely.

Operating from Italy

(Standard Solution)-

Capital gain: 26%

-

Obligation of declaration and taxation in Italy

-

It is the right choice for those with small capital, who prefer to avoid complexity and have no need to maximize tax performance.

Operating from Bulgaria

(EU Solution)Think about it!

-

Capital gain: 10%

-

Perfect solution for those who want EU legality

+ tax efficiency

-

Our team assists you in setting up your Bulgarian company or offers you the possibility to operate within our already active structure.

Operating from Hong Kong

(Non-EU Solution)-

Capital gain: 0%

-

Possibility to open a remote account

(without traveling to HK)

-

It is the ideal choice for informed investors, with larger capital and oriented toward active and professional management.

WHAT WE OFFER

In the Mathematical Investor team, we know that every situation is unique. That’s why we offer you:

✔️ Free personalized consultation to analyze your tax position

✔️ Full support to open foreign companies and bank accounts (EU or Non-EU)

✔️ Access to our partner channels to simplify bureaucracy, documents, and costs

✔️ Scalable solutions: from a simple copy-trade account to your own company

READY TO CHOOSE THE RIGHT PATH FOR YOU?

👉 [ Contact us today for a free consultation → ] and let’s start building your operational plan together.